Overview

The company sought to gain a deeper understanding of the market potential within the pharmaceutical industry, mainly focusing on brand pharmaceutical companies. Using limited internal data, we developed a comprehensive market sizing model that enabled the company to estimate the total market opportunity. By leveraging the principle of relative revenue multiples, we provided a detailed market size estimate and identified key opportunities across the industry. Additionally, we researched which pharmaceutical products aligned with the company’s offerings, uncovering new growth opportunities.

Challenges:

- Limited Internal Data: The company had limited visibility into the broader pharmaceutical market beyond the revenue generated from existing customers, making it difficult to accurately estimate the total market potential.

- Complex Market Dynamics: The pharmaceutical industry includes a wide range of products, companies, and market segments, which made it challenging to identify relevant opportunities within the company’s product range.

- Need for Actionable Insights: Beyond calculating market size, the company required actionable insights to identify the best growth opportunities within their target market.

Our Approach:

Revenue Multiplication Methodology

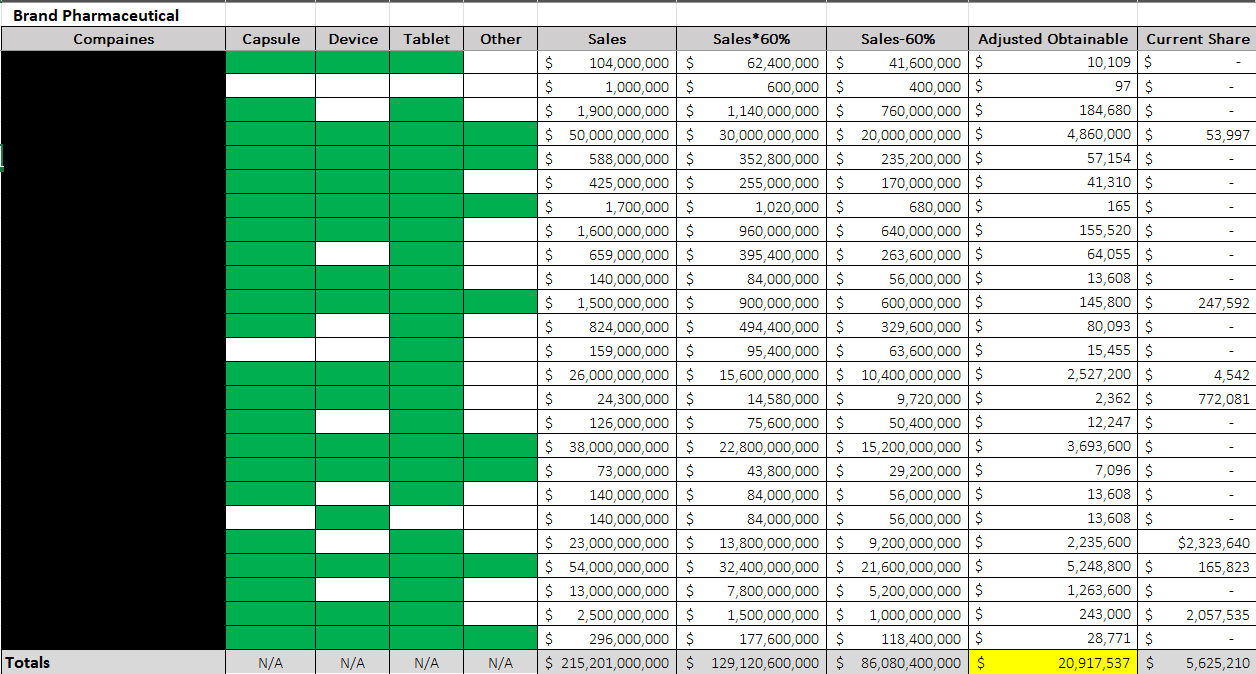

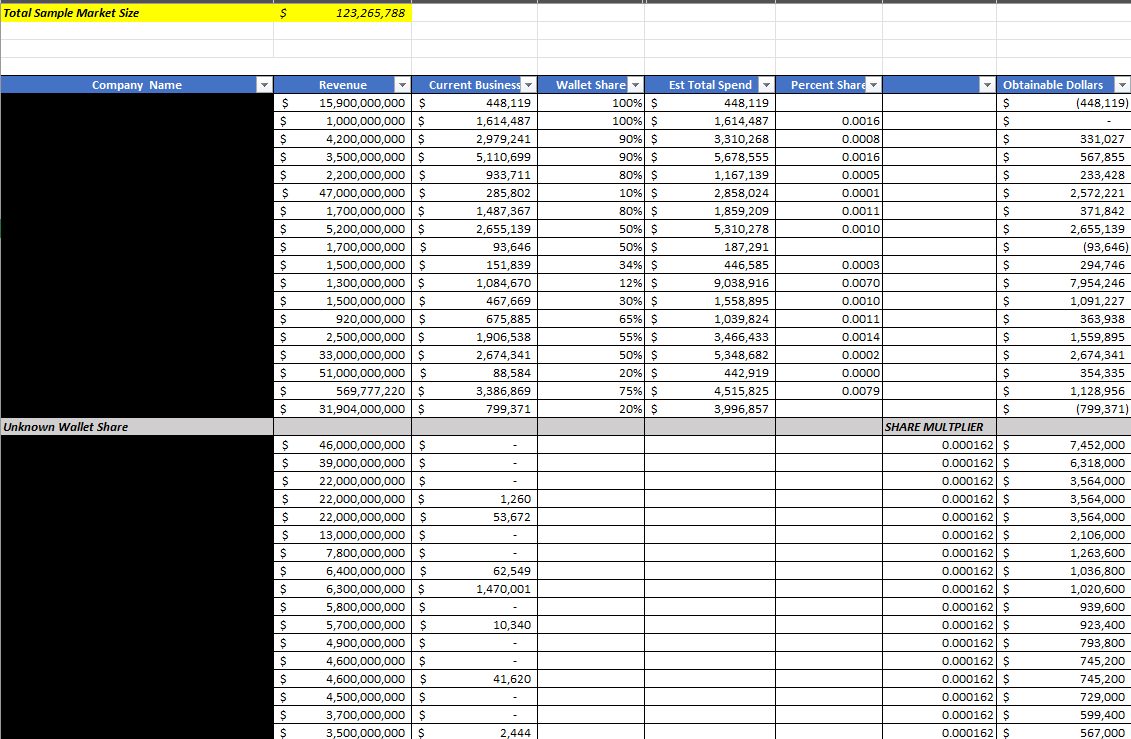

Our first step was to leverage the company’s existing customer data. By applying a revenue multiplication methodology, we estimated the total market size across other brand pharmaceutical companies.

-

- Establishing a Benchmark: We started by identifying key pharmaceutical companies that knew they had captured 100% of the relevant business. For each of these companies, we compared the revenue the company generated with its total revenue. This allowed us to calculate a specific multiple, which represented how much of the company’s revenue reflected the overall size of the market segment for that company.

- Calculating Multiples: We repeated this process for every pharmaceutical company where the company had a complete picture of its market penetration. For example, if Company A’s total revenue was $500 million, and our client’s revenue from Company A was $5 million, we calculated a multiple of 100x. This multiple indicated that the company’s current revenue represented 1% of the total opportunity with that client.

- Applying the Average Multiple: Once we established multiples for all companies with complete data, we calculated the average multiple. We then applied this average multiple across the industry, allowing us to estimate the potential market size for other brand pharmaceutical companies where the company did not have complete revenue visibility. This provided a clear view of the overall market potential within the pharmaceutical sector.

Industry-Wide Market Sizing

Once the average multiple was established, we applied it to the broader brand pharmaceutical market to estimate the company’s total market size and potential revenue opportunities.

-

- Scaling Across the Industry: Using public data, we identified the total revenue of other pharmaceutical companies relevant to the company’s offerings. By applying the calculated average multiple, we estimated the potential revenue that could be generated from each company if it captured 100% of the applicable business.

- Segmenting Market Opportunities: We further segmented the market based on different pharmaceutical product lines, focusing on those aligned with the company’s core competencies. This allowed us to refine the total market size calculation and focus on the most promising opportunities within the broader market.

Researching Product Alignment

We conducted in-depth research into the types of products these pharmaceutical companies sold to refine our market sizing and opportunity identification process. The goal was identifying which products fit the company’s capabilities and product range.

-

- Product Portfolio Analysis: We analyzed each pharmaceutical company’s product portfolio, focusing on specific products that matched the company’s offerings. For example, we looked at products that required particular packaging, materials, or supply chain solutions that the company already provided.

- Identifying Strategic Fits: We identified specific product lines or business areas where the company could provide a strong value proposition based on this analysis. This helped prioritize which pharmaceutical companies represented the best opportunities for further engagement.

- Cross-Referencing Market Data: By combining our product research with the revenue multiples, we could cross-reference the potential market size with the company’s likelihood of securing business in each area. This allowed us to pinpoint high-value opportunities with favorable market potential and product alignment.

Developing a Market Opportunity Roadmap

After determining the market size and identifying the most promising opportunities, we developed a strategic roadmap for capturing new business within the pharmaceutical sector.

-

- Prioritizing Targets: We ranked pharmaceutical companies and product lines based on the potential revenue opportunity and alignment with the company’s product capabilities. This helped focus business development efforts on the most lucrative and achievable targets.

- Creating Tailored Strategies: For each high-priority opportunity, we recommended tailored strategies for approaching the target companies. This included recommendations for positioning the company’s offerings to address the specific needs of each pharmaceutical company, focusing on products where the company could deliver the most value.

Results:

- Comprehensive Market Size Estimate: By applying the revenue multiples methodology, we estimated the company’s total market size within the brand pharmaceutical sector, providing a clear picture of the industry’s revenue potential.

- Identified High-Value Opportunities: We identified specific pharmaceutical companies and product lines where the company had the highest likelihood of success, focusing business development efforts on the most promising opportunities.

- Informed Strategic Decision-Making: The market opportunity roadmap provided the company’s leadership with actionable insights and a clear strategy for expanding its presence within the pharmaceutical industry.

Through a combination of data-driven market sizing and in-depth product research, we provided the company with a clear view of the revenue opportunities available in the pharmaceutical sector. By leveraging internal data and applying it industry-wide, we identified high-potential opportunities. We created a roadmap for capitalizing on these opportunities, positioning the company for future growth in a vital market.